|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

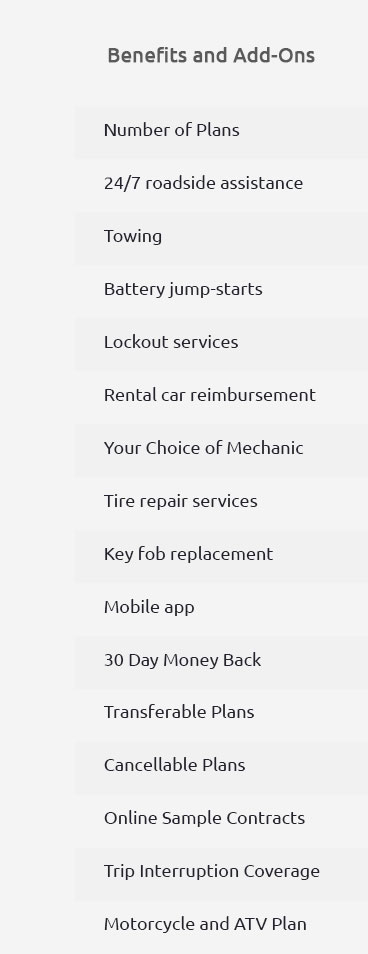

Rental Car Gap Insurance: Coverage Guide for U.S. ConsumersUnderstanding rental car gap insurance can be a game-changer for anyone in the U.S. renting vehicles. This guide will delve into the essentials of rental car gap insurance, offering peace of mind and potential cost savings. What is Rental Car Gap Insurance?Rental car gap insurance covers the difference between the actual cash value of a rental vehicle and the amount you owe in the event of a total loss. If you're driving a rental and it's involved in an accident, you might be responsible for more than just the repair costs. This insurance fills that gap. Why Consider It?

Key Benefits for U.S. ConsumersIn the U.S., especially in bustling cities like New York or Los Angeles, rental car gap insurance can be a lifesaver. It ensures you're not financially burdened if your rental vehicle is totaled. Example ScenarioImagine renting a car in Los Angeles and getting into an accident. Without gap insurance, you might pay thousands more than the car's worth. With it, you're covered for that difference. Considerations Before PurchasingBefore purchasing rental car gap insurance, review your existing policies and warranties. Many options, like the honda warranty extension, might already cover certain aspects. Ensure you're not doubling up unnecessarily. Common Misconceptions

FAQs about Rental Car Gap InsuranceDo I need rental car gap insurance if I have a personal auto policy?Your personal auto policy might cover rentals, but check for gaps. Rental car gap insurance can fill those. Is rental car gap insurance necessary for short-term rentals?For short-term rentals, it's often wise to have this insurance to avoid unexpected costs, especially in high-risk areas like New York City. For further insights on vehicle protection and how to extend your vehicle's warranty, explore my car warranty to find the best options for your needs. https://www.enterprisecarsales.com/service-contracts-and-protection-products/gap/

GAP covers the difference between what your insurance pays and what you owe. - In some states, GAP may also cover up to a $1,000 deductible. - With GAP, there are ... https://www.bogleheads.org/forum/viewtopic.php?t=422639

The problem is that the rental car side (third party used by Avis) is asking for a much larger amount than the insurance company is paying. https://www.hertzcarsales.com/hertz-gap-protection.htm

Total Loss Protection, commonly known as gap insurance, covers the difference between what you still owe on your car loan and what the insurance provider pays ...

|